Thanks to backing from SCOR, Lancaster University Management School (LUMS) in the UK is to further strengthen its novel 'prediction market', designed to help forecast future climate-linked risks.

The SCOR Corporate Foundation for Science has provided backing to Lancaster University Management School for the first two years of an initiative to develop long-horizon forecasts of climate-risk outcomes.

The funding will develop the Climate Risk and Uncertainty Collective Intelligence Aggregation Laboratory (CRUCIAL) — an initiative led by Lancaster University Management School with support from Exeter University — which uses ‘prediction markets’ (market-like mechanisms to combine different sources of knowledge and expertise) to generate forecasts of future climate-related risks.

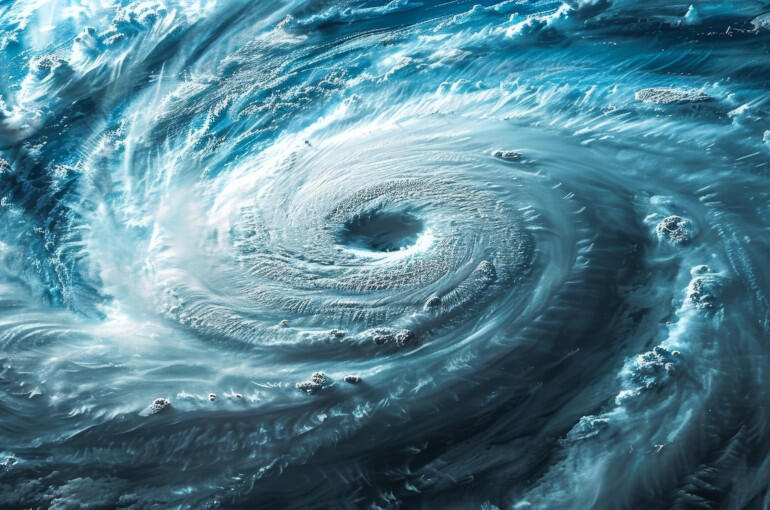

As climate change continues to affect air and sea temperatures, historical records of significant weather events are no longer reliable to forecast the future. Events such as hurricanes, which are the strongest and most destructive atmospheric events, begin in warm ocean waters and can have a devastating and widespread impact on agriculture, wildlife, property - as well as human life.

Dr Kim Kaivanto from Lancaster University Management School leads the CRUCIAL project. He said: "As our world's climate changes, data from distant decades become less useful guides to the future. Yet, accurate forecasting is arguably more crucial - to save lives, to inform adaptation, and protect our global economy.

“This is where prediction markets can make such a difference. They broaden the range of techniques and data sets being brought to bear upon individual forecasting questions and offer a radically new approach to funding climate forecasting — in a performance-driven way.

“For reinsurance companies like SCOR, this could be a real step change in the diversity of different sources of forecast-relevant information. CRUCIAL has already demonstrated the viability and calibration of expert prediction markets for climate-linked outcomes. This significant funding will enable us to take CRUCIAL toward our aspiration of multi-year, indeed decadal-horizon forecasts. The intention is to create a new joint-outcome market that simultaneously forecasts not only the global temperature anomaly, but also atmospheric CO2 concentration and the dependence structure between these two variables. Having this dependence structure present in the forecast is particularly valuable for informing policy making, planning, and decision making."

CRUCIAL’s development at Lancaster University started in mid-2022, when the AGORA prediction market platform originally developed at Winton Capital Management was donated to Lancaster University.

In late 2023 CRUCIAL launched the 2024 season Atlantic hurricane market, attracting teams from academia (60%) and the private sector (40%) to produce a collective forecast that evolves in real time.

CRUCIAL invited experts to join the market which allows them to use their specific knowledge, modelling, and expertise to buy contracts on specific hurricane-count outcomes — up to the price that their modelling and judgment indicates is warranted. The AGORA platform’s automated market maker ensures that participants, using their different and diverse expertise and modelling, can always buy or sell contracts so that their expertise and judgment is incorporated into the market’s prices.

The prevailing prices at which these contracts trade can be interpreted as the probabilities of the number of hurricanes that will take place.

These prices evolve as more information becomes available, providing decision makers with an up-to-date forecast that incorporates the expertise and knowledge of all the participants.

Participants in the CRUCIAL market do not have pay to take part, as in some other prediction markets, but are eligible to receive cash rewards based on the accuracy of their contributions.

Dr Mark Roulston led the development of the AGORA prediction market platform at Winton Capital Management. He said: “Prediction markets are not a substitute for climate forecasting expertise, but a new way of synthesizing that expertise. We are harnessing the proven ability of markets to aggregate information to get better predictions of climate-related risks.”

Philippe Trainar, Director of the SCOR Foundation for Science, highlights the interest of a reinsurer like SCOR in the CRUCIAL project: "The consequences of climate change are currently and will remain in the future the subject of lively controversy between experts.

“Prediction markets have demonstrated their unrivalled capacity to anticipate future trends in such controversial areas, where it is necessary to quickly combine scientific results, statistical observations and learning from experience."

SCOR’s Corporate Foundation for Science, the philanthropic arm of the giant reinsurance firm, aims to support research development and university scientists involved in work related to risk analysis.

The Foundation’s funding will support CRUCIAL’s infrastructure and personnel required to run markets, and to provide incentives to market participants.

You can find more information on the Foundation’s dedicated project page.

About the SCOR Foundation for Science

The SCOR Corporate Foundation for Science forms part of the SCOR reinsurance group's long-term commitment to research and the dissemination of risk-related knowledge. This commitment is an integral part of SCOR’s DNA, as illustrated by the Group’s tagline, “The Art & Science of Risk”. Risk is the “raw material” of reinsurance, and SCOR stays at the cutting edge of risk expertise and research through its vast network of academic institutions, as well as through the support it provides to numerous disciplines including mathematics, actuarial science, physics, chemistry, geophysics, climatology, economics, finance, and more.

About CRUCIAL

CRUCIAL (Climate Risk Uncertainty and Collective Intelligence Laboratory) is an initiative between Lancaster University Management School and the Land, Environment, Economics and Policy Institute at the University of Exeter to use prediction markets, with expert participants, to produce collective forecasts of climate-related risks.

About LEEP

LEEP (Land, Environment, Economics and Policy Institute) is an interdisciplinary research group, with core economic skills combined with expertise in natural, physical and social science, located within the University of Exeter Business School. LEEP integrates expertise from natural and physical science research within environmental economic analyses, which is the hallmark of its policy advisory work and the research that it produces across a variety of fields.

https://www.exeter.ac.uk/research/leep/

About LUMS

Lancaster University Management School (LUMS) is the leading business school in North-West England, and consistently receives high rankings in research and teaching (REF, TEF, Financial Times, QS, The Times, Guardian). In the 2021 Research Excellence Framework evaluation, LUMS ranked #1 in the UK for research power. LUMS is among only 1% of business schools that enjoy triple accreditation (AACSB, EQUIS, AMBA).