Final Report | The effects of inflation on insurers’ performance and value

Funded by the Foundation, this project ran from 2023-2025

The SCOR Foundation research project “The effects of inflation on insurers’ performance and value” has published its final report.

Running from 2023-2025, this project was led by Georges Dionne, Full Professor in the Department of Finance at HEC Montreal.

Final Report Abstract

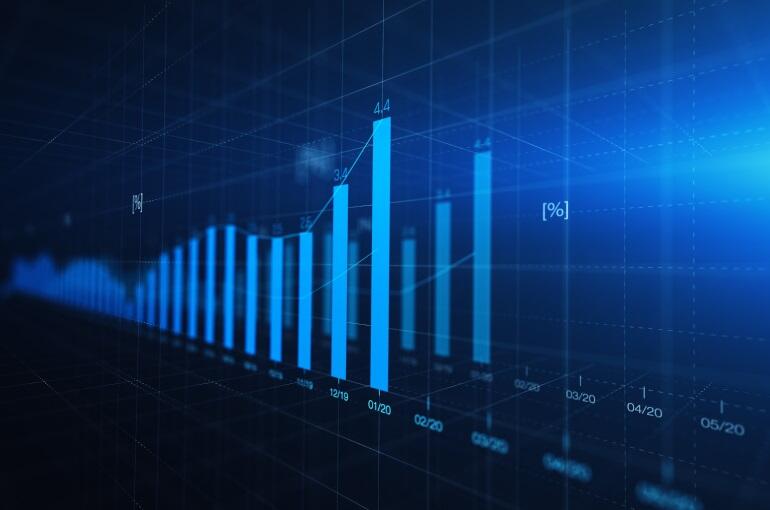

The aim of this study is to analyze the impact of inflation risk on insurers in the US insurance industry. The United States has experienced three inflationary shocks since 1973. The first two were related to oil price shocks while the third one was linked to the COVID-19 pandemic.

Our first results, from the ARDL model and Error Correction Model (ECM), indicate that Premiums, Total expenses, and Net investment income were positively affected by inflation in both the P&C and the Life sectors. These effects seemed to compensate each other since profitability variables such as Combined ratio, Operating ratio, Pretax operating income, and ROA were not affected by inflation. These preliminary results may be explained by the implicit assumption of linearity in the stochastic inflation processes in the above models.

We then verified that the inflation rate series was characterized by a random trend and nonlinear dynamics. We selected the two-regime Markov model to study the impact of inflation on various fundamental indicators of performance. The P&C sector have been more affected by inflation during our period of analysis. The negative effect on Premiums in the high inflation regime, probably explained by a reduction in purchasing power of clients, affected insurance demand and the higher interest rates did not compensate for the negative underwriting results. In the life sector, the hedging effects of investments were efficient.

We also evaluated the impact of inflation on Reinsurance demand, Liquidity creation ratio, and ROA for P&C US insurers, with panel data and a particular attention to differences across firm size. Findings from a GMM model, indicate that large insurers adapted more quickly to inflation. In the last section, we describe how the US property and casualty insurance industry is subject to social inflation and to what extent in 2025.