Interim Report | The effect of inflation on US insurance markets

Part of the SCOR Foundation research project “The effects of inflation on insurers’ performance and value”

The SCOR Foundation research project “The effects of inflation on insurers’ performance and value” has delivered an interim report under the title “The effect of inflation on US insurance markets.”

Running from 2023-2025, this project is led by Georges Dionne, Full Professor in the Department of Finance at HEC Montreal.

Interim Report Abstract

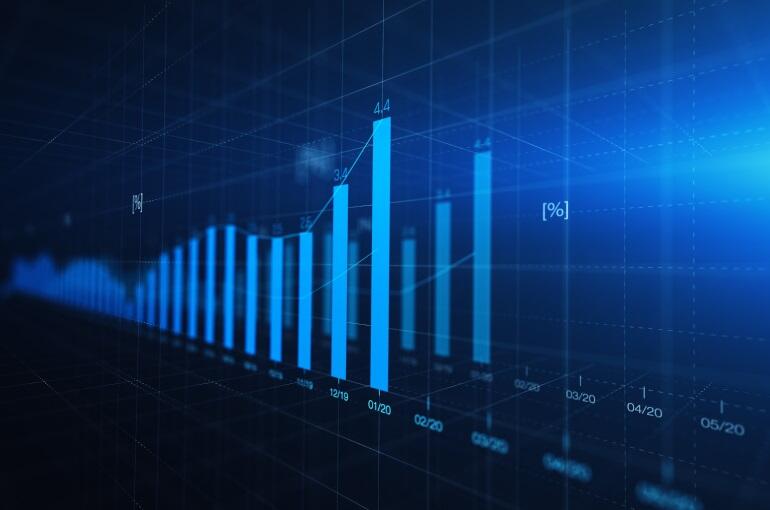

We analyze the effects of inflation on the US insurance industry. The analysis is based on initially on a VAR (Vector AutoRegressive) model. The shock of the COVID-19 pandemic had a significant positive short-term impact on inflation, probably explained by the recent contractionary of the Fed monetary policy against inflation. We then analyze the characteristics of the U.S. inflation rate series observed over the 1973-2023 period in order to capture and model the effect of inflation on the insurance industry. Two important conclusions emerge from this analysis: The US inflation rate series is characterized by non-linear dynamics (asymmetry) and a random trend. The results obtained led us to select the two-regime Markov model to analyze the impact of inflation on the various fundamental indicators of insurance company performance in the US. We show that performance indicators are differently affected by inflation in the Life and P&C insurance sectors according to the inflation regime considered.

Keywords: Inflation, US insurance industry, Markov model, COVID-19 pandemic, Life Insurance, P&C insurance, AM Best, American Council of Life Insurers.